Urbanization & The Middle Class

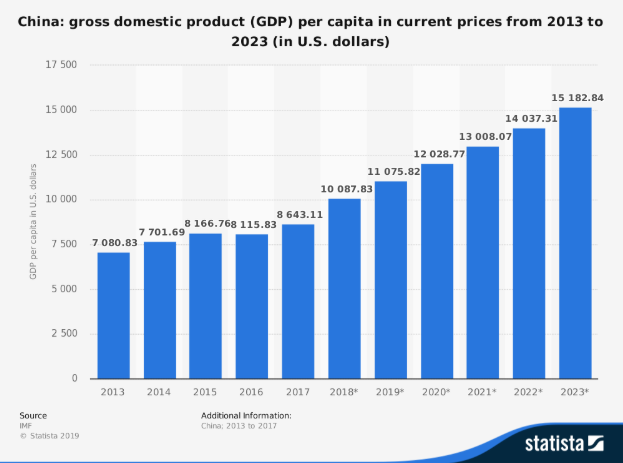

Over the last twenty years in the nation of China, one thing is clear; the nation has undergone and still is experiencing an economic expansion that is unprecedented in modern history. According to the World Bank, over 800 million Chinese citizens have risen out of poverty since 1990. That number alone is twice the number of the U.S. population. What was once a country that used to make up a large percentage of the world’s poor has now mobilized into a significant portion of the world’s middle class. Just over a decade ago, the GDP Per-Capita of China was $3,500. Today? $8,600.

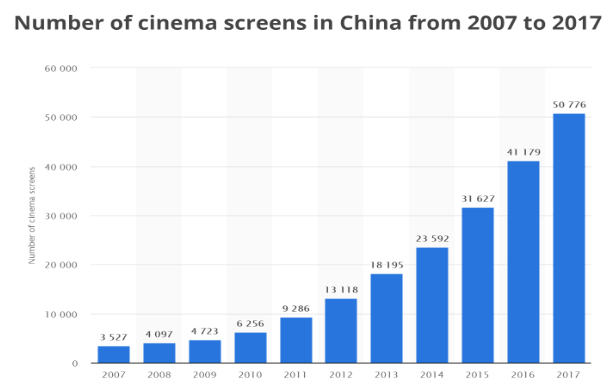

So what does this have to do with the film industry? The growth of China’s middle class has created a massive market for the entertainment industry with newfound spending power. In the first quarter of 2018 for the first time ever, China surpassed the United States in box office revenue. According to Vox Media, for the past two years China has built an average of 27 cinema screens per day! According to the economic firm PWC’s entertainment and media outlook (2017-2021), China is expected to house over 80,000 screens by 2021. That is twice the number of screens the United States is expected to have. Furthermore, it is clear the future of lucrative growth in the film industry lies within the Asia Pacific. In the same study by PWC, it was reported that the Asia Pacific region is expected to have a healthy Compound Annual Growth Rate of 8% for the next five years.

I believe that this growth in China’s film industry is largely attributed to two reasons: the urbanization of the Chinese population and the population’s significant increase in disposable income. If you take a look at Figure 2, the graph explicates one of several results of what is occuring. The graph represents the number of cinema screens in China from 2007-2017, and the growth is extraordinary. In 2016 for the first time ever, China surpassed the United States in nationwide cinema screens. According to the National Association of Theatre Owners, the United States housed 40,009 screens in 2016, where in comparison China had surpassed that number and was home to over 41,000 screens. In 2017, China built nearly 10,000 more screens giving the nation an ample lead over the historic film capital of the world.

Urbanization and the middle class in China:

The migration of rural populations to urban areas is an important facet to the spur of the movie industry because of accessibility to cinema screens and box offices.

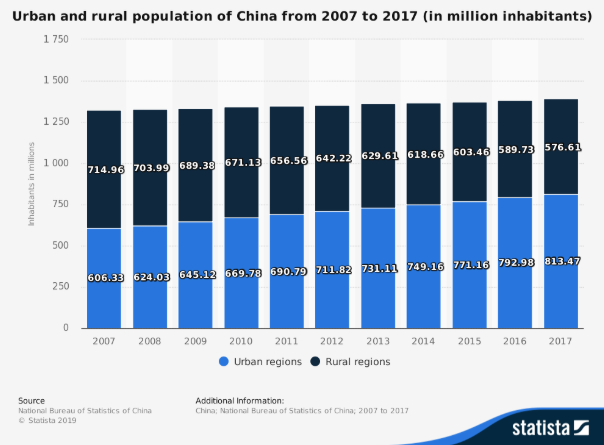

Forty years ago, 17% of China’s population lived in urban areas. Today, the percentage stands at a staggering 58.5%. That equates to over 600 million people who have migrated from rural to urban areas over the last four decades. The number of Chinese who currently reside in urban areas is nearly double of the population of the entire United States (327m). So why does this mass migration correlate to the growth of the film industry in China?

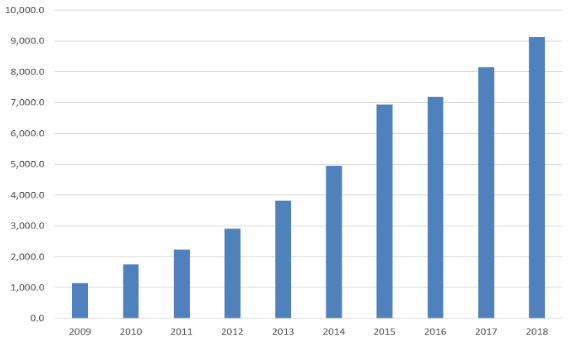

The migration of rural populations to urban areas is an important facet to the spur of the movie industry because of accessibility to cinema screens and box offices. Many of those 27 screens per day being built in China are being built within the enormous shopping malls located in the metropoli of China. When a family or individual moves to an urban region not only are there more work opportunities and increased monthly wages but also a likelihood for a shift in lifestyle as well such as dining out, more leisure time, and a desire to consume entertainment. If you look below at the two figures, each visually represent a correlation of growth. Figure 3 (information sourced from the National Bureau of Statistics of China) represents a Chinese citizen’s average disposable income from 2009 to 2017.

* The measure of disposable income was measured as such: Disposable income = total household income – income tax – personal expenditure on social security – sample household subsidy for keeping diaries.

* These figures equate to a 111.9% increase in disposable household income in China over a 9 year span. Which ultimately means more cash to spend at on dining, clothing, and most importantly movies.

Figure 4 represents the population of rural inhabitants in China in comparison to urban inhabitants in China. The statistics were sourced from the economic firm Statista. The percentage of growth from the same time frame (2009-2017) as figure 3 is 26.09% which is not as staggering of an increase as disposable household income in China over this 8 year time frame, but does show a correlation in increased wages and nationwide economic development regarding migration to urban areas. It also means that more and more citizens are in closer proximity to entertainment and leisure activities.

Film revenue:

These two factors of rising disposable income and migration to urban areas spells out success for the film industry, and the numbers demonstrate so in box office revenue. See below for figure 5, which illustrates the year over year box office revenue in China. The information was sourced from Ibis World’s comprehensive report on the cinema industry in China.

This graph paints a clear picture of a combination in growth and volume unprecedented in the business of film. From the period of 2009-2018 there was box office revenue growth of 696%.

The figures and statistics expressed have shown:

- The GDP per capita of China has increased greatly over the last 15 years

- The number of cinema screens in China has increased greatly over the last 10 years

- The average disposable income of a Chinese household has increased by over 100% in the last ten years

- 58% of the Chinese population reside in urban areas, which results in easier access to going to cinemas

- The box office revenue has grown rapidly year over year for the last decade, and from 2009-2018 grew 696%